COVID Money-Printing is Still the Cause of Inflation

What "Creeping QE" means for the markets today

Governments will exercise thrift inasmuch as it is politically convenient. High employment, high productivity, high earnings and a high standard of living are the only economic configuration that produces circumstances where voters (or “the rabble” in monarchy) will refuse to substitute taxes with handouts. If they feel they earn their keep and are happy with the result of their private decisions, they won’t view taxes as acceptable and won’t be desirous of the direct benefits that might otherwise only benefit the most impoverished and infirm in society.

This being the case, governments can produce wealth through the following means, but only in combination: a healthy, educated and skilled workforce, functioning infrastructure and access to capital, credible property rights, sufficient protectionism to ensure the development of key domestic industries, cheap resources or inputs, and sufficient credit creation to provide confidence in the future, the ability to take risk, the ability of financing to be available on an extended basis and the confidence that mildly inflationary monetary circumstances will deter the underlying deflationary effects of a highly productive economy.

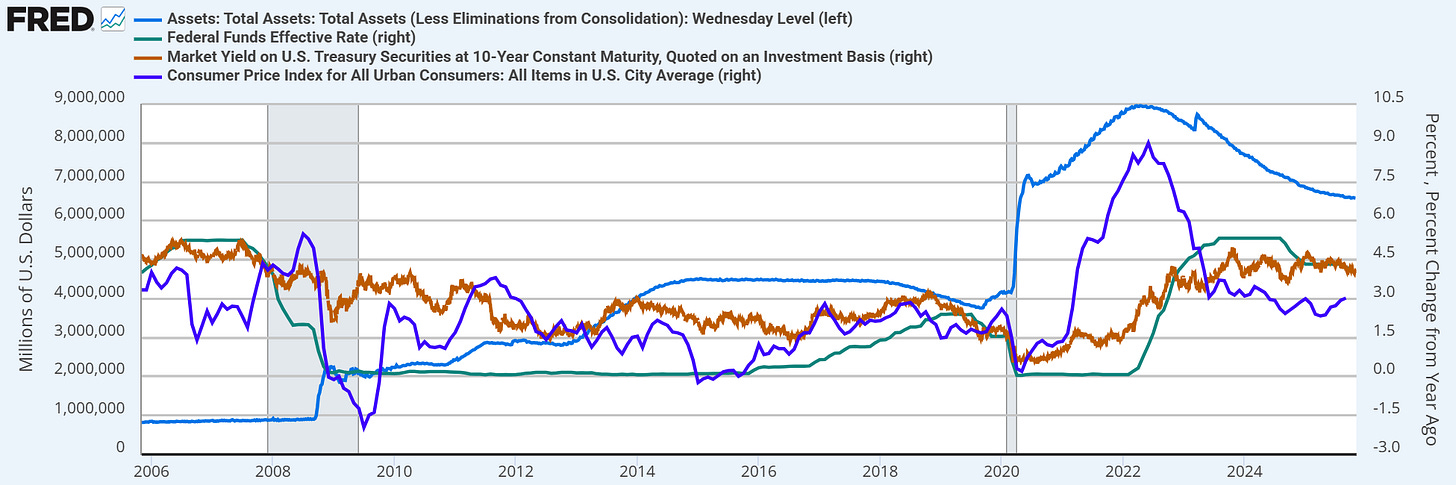

With the introduction of QT and the raising of interest rates through 2022-23, the Fed effectively restricted the new flow of capital into the broader economy while also diminishing the availability of financial assets. This is the equivalent of “jamming on the breaks” to stop inflation, after Powell kept assuring the markets that inflation was transitory.

Now, the variance between the fed balance sheet, bond yields, interest rates and inflation have all returned to some level of synchrony - similar to what was observed from 2014 to 2020 - but now growth has started to suffer for it. The Fed is realizing its position is increasingly untenable in a capital constrained environment, while the US government lacks the dry powder necessary to engage in traditional Keynesianism and the reconfiguration of the US economy through tariffs and tax relief to domestic production means both short-term inflation AND increased private-sector demand for capital to stand up the new facilities needed to on-shore production.

The Fed has indicated that it will continue to lower the funds rate through the end of the year, but it appears that they are also beginning to consider increased QE in order to meet the needs of domestic capital markets while diminishing the impact of their previous capital-constraining approach. This will inevitably lead to inflation, but not the same inflation that the Fed produced by backstopping the looney-tunes approach the US government took to COVID (as was the case for governments around the world).

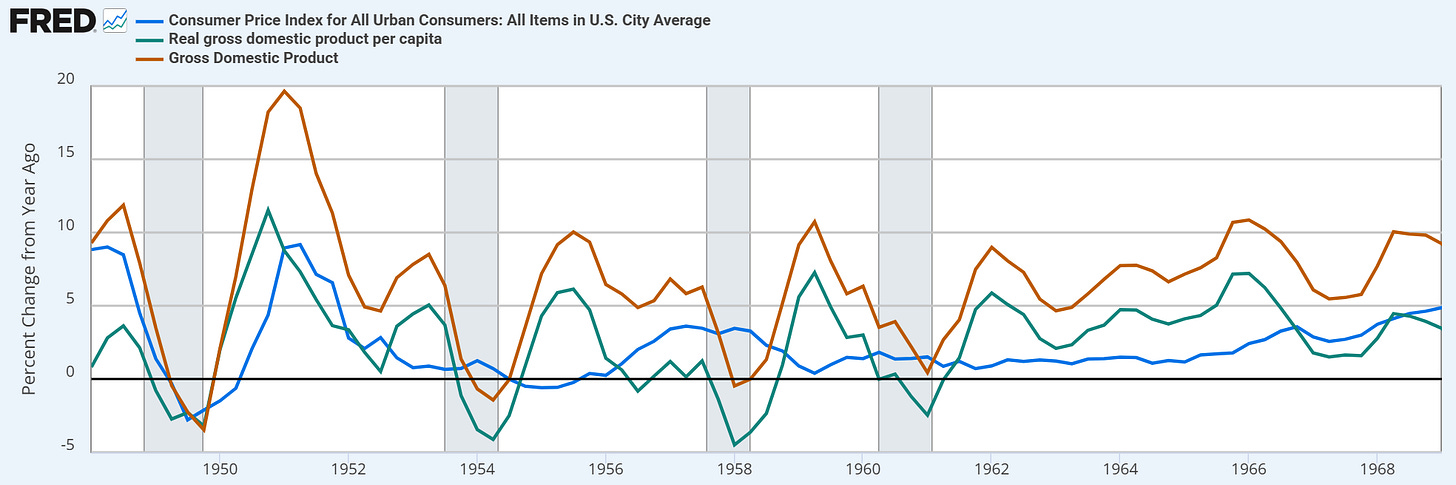

Where capital goes to productive capacity, before the production can be realized, inflation will be inevitable - this applies as much to the United States today as it did to Stalin’s Russia or Mao’s China. What the Fed must do is permit a recapitalization of the US Industrial base - inflation come as it may - in order to realize a reconfiguration of the US economy similar to what occurred in the 1950s, where recapitalization with new technology led to various small boom-bust cycles in the economy, but a real standard of living improvement that was perceived to be unparalleled in human history - probably to this day.

The COVID-era backstopping of the economy was a reaction to foolish economic and health policy, but at the time it brought about questions as to whether Modern Monetary Theory was already in place. The reality is that, if it is an accurate description of how money works, then it always has been. But if money works in such a manner that it only need be created in order to fund the pursuit of societal goals, how does one create money without compromising thrift?

The truth is, any direct benefit compromises thrift, even if it is to the disabled, the infirm or the incapacitated. This is an awful thing to say, and to abandon those groups would be criminal, but it also speaks to what we discourage and encourage as a society. Do we encourage waste, fraud and abuse? Do we encourage idleness? Or should we have policies that make people more productive? That make it easier to make use of the divisions of labor which produce the wealth of successful economies?

Those divisions require stability and predictability, something the Fed has hardly seemed to provide.