Food Inflation, Credit Creation and The Trouble with Mega Projects

Governments See Big Investments as a Way Out of Economic Malaise, When Only Many Investments Will do the Trick

Governments of the West are struggling to keep up with the rate of development seen in Asia, even as various bridges to nowhere may collapse with astounding alacrity. Centralized development is viewed as the primary lever to increase economic growth, but it fails to account for the actual division of labor, the creation of supply chains, the specialization of firms, the concentration of lower costs that is necessary to deliver many goods and services efficiently and cheaply to a large population.

Take for example: StarGate in the United States, a supposed 21 trillion in foreign direct investment commitments before the end of this year, 1.1% of GDP growth coming from AI data centers, €2 trillion euro stimulus in the EU, Canada attempting to unfurl an increasing number of mega projects.

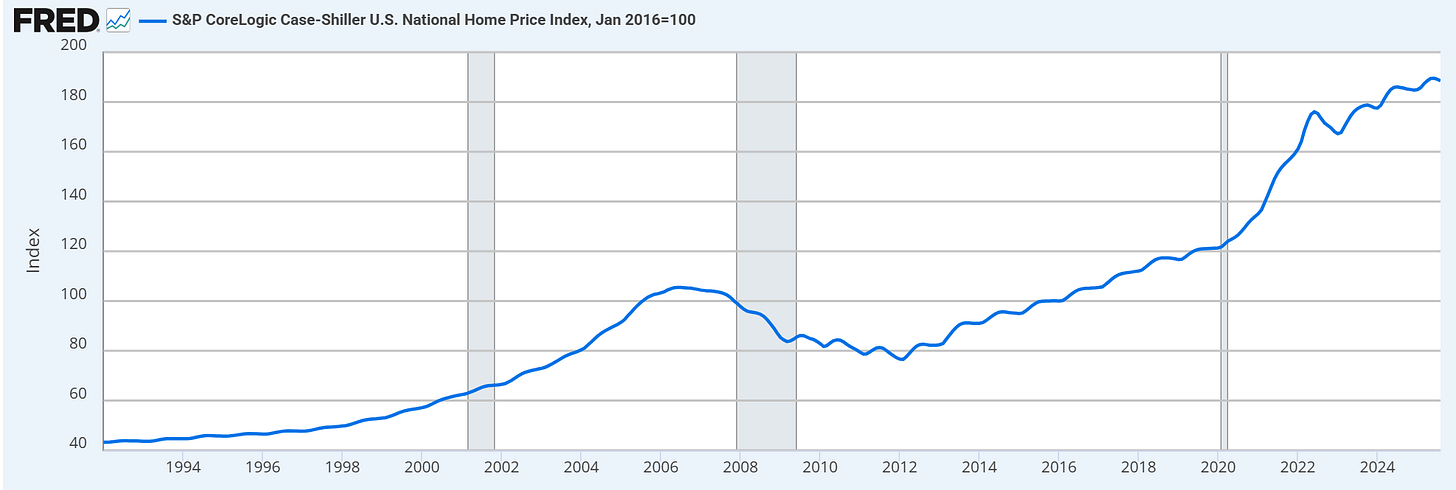

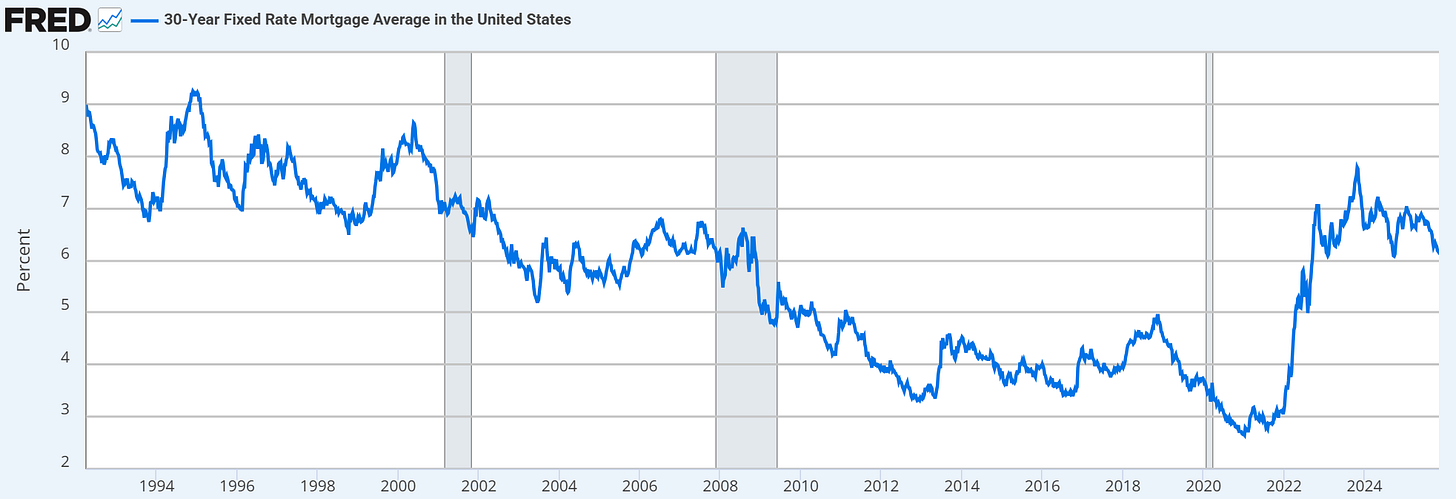

This kind of centralized development approach is both the symptoms and cause of a broader disease: the myth of effective centralization. The primary political issue in most Western democracies today is the cost of living, which applies all basic goods including: food, transportation and housing. This is taking place while employment is considered relatively high, labor force participation has increased, and energy prices have consistently maintained a lower and lower clip.

source: https://fred.stlouisfed.org/series/PNRGINDEXM

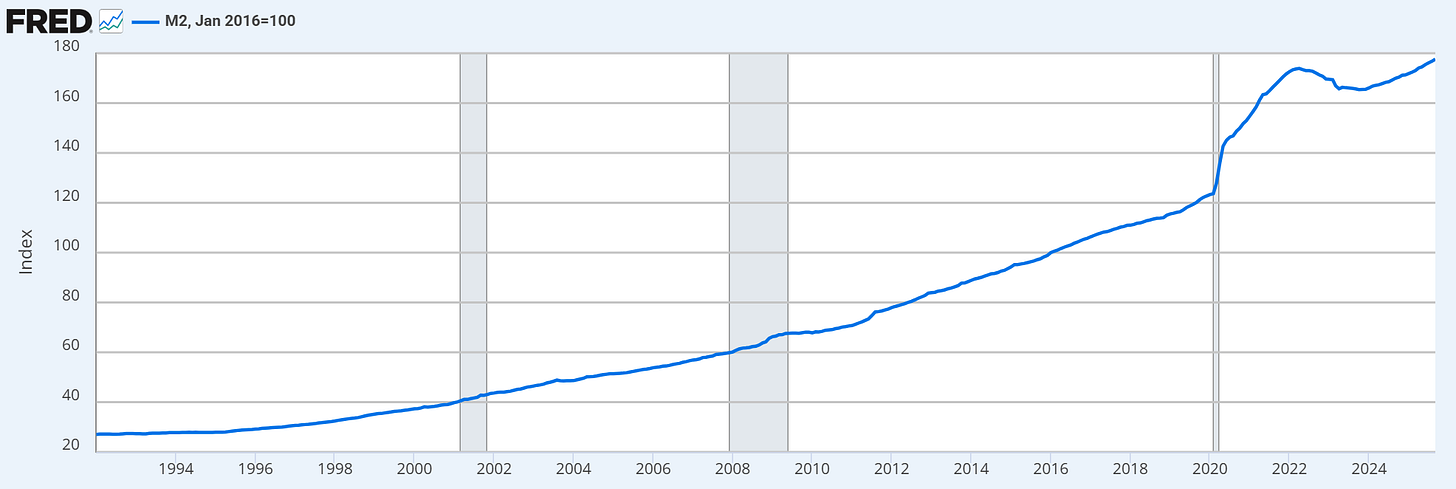

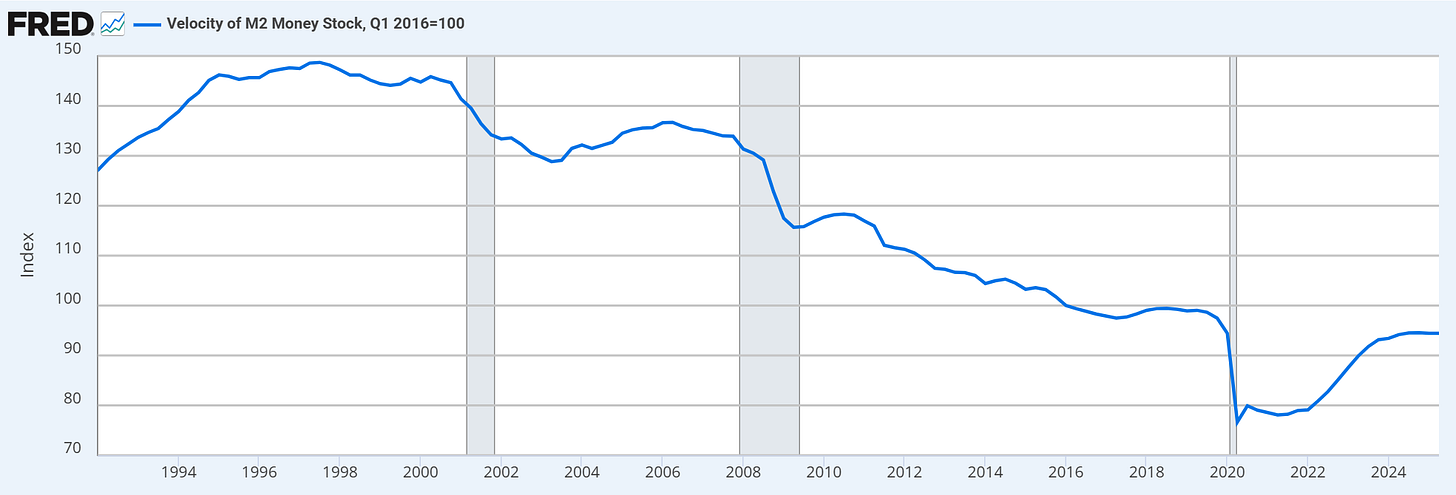

source: https://fred.stlouisfed.org/series/M2SL

source: https://fred.stlouisfed.org/series/M2V#

source: https://fred.stlouisfed.org/series/PFOODINDEXM

source: https://fred.stlouisfed.org/series/PALLFNFINDEXM

source: https://fred.stlouisfed.org/series/CSUSHPINSA

source: https://fred.stlouisfed.org/series/MORTGAGE30US

Realistically, the cost of living seeing a continuous increase has become an economic constraint on its own - one of the primary causes of people having fewer and fewer children, which ultimately leads to labor importation or otherwise substitution, which then increases total costs of production, goods and services.

Just like how median consumers have a higher marginal propensity to consume than the average billionaire, small businesses are more prone to dedicate their available cash and credit to actual productive economic activity. Yet, between 2019 and 2023, in a period when credit creation was essentially unparalleled, small business lending actually decreased by 18%. Small businesses in Canada are falling behind on loans and experiencing increasing delinquencies, while European SMEs have increasingly limited their use of debt despite particularly low interest rates.

So how can one explain relatively stable commodity prices, but low growth, business formation, low lending to entrepreneurs, pie-in-the-sky megaprojects and an otherwise rising cost of all the goods and services which compose daily life? The fundamental reason is an economy of middlemen - habits of mind in the US, Canada and the EU which encourage businesses to firstly avoid risk, then secondly avoid competition, while government discourages competition, particularly on price, in such a manner has served to raise costs throughout the supply chain into the long term.

By contrast, the Chinese and other Asian banking systems are designed by governments to increase the rate and frequency of business formation and to encourage even novice entrepreneurs to be ambitious. At the other extreme, this practice can lead to an excess accumulation of non-performing loans, but it does wonders for overall growth. At the same time, many of China’s largest projects - whether it’s EV batteries, cement plants or massive real estate developments - are at far more risks of non-performance than the average mom-and-pop shop. Indeed, the fascination with megaprojects ignores their tendency to be over-time, over-budget and often under-deliver on total economic impact, yet as westerners see dazzling displays from China, it becomes the new shiny object here at home.

“Big bold investments” and “public-private partnerships” may seem like an effective way to create economies of scale, but in reality they fail to create dynamic growth, inhibit innovation, limit accountability by diffusing responsibility, and their benefits fail to exceed the costs of scale - slow-moving, inefficient, unresponsive systems that add middlemen, price and bureaucracy without creating more value.

The rise of megaprojects is effectively an attempt to overcome the overall decline in economic vitality seen in the West since the post-war economic boom, but a fundamental corollary and cause of this has been a decline in the access to credit, where banking institutions are increasingly concentrated in the US and elsewhere with little incentive or encouragement to push credit “further out on a risk curve” in a manner that encourages a virtuous cycle of economic growth - where many businesses take risk at once, see higher rates of transaction between themselves and consumers, and end up being increasingly credit worthy because the velocity of money is sufficient to ensure they can make their loan payments.