The Horizon of a Thousand Suns

Why the Fiction of Financial Markets may actually be the World's Best Friend

The global community is currently in a power reorientation, a financial reorientation and a productivity reorientation. Generational transition combined with new technologies and new “habits of mind” mean that traditional orders and attitudes will fall by the wayside, and in their place, leaner, flexible and more responsive systems - whether they be institutional, corporate, or driven by mass behavior - will rise up to take their place.

The first and most important order is the current financial transition. This is the predicate to power transition, as it relates to the competition between the Anglo-American banking cartel and China. There are, subordinately, two sides to take in the argument about China: either it has already surpassed the West or it is a paper tiger. China has engaged in gross debt monetization to fund its public works, infrastructure and industrial development, and yet has not paid the consequences at a systemic level.

To be clear, Chinese citizens pay for it by working long hours in difficult jobs, suffering rising costs of living and financial repression, but much the same could be applied to the experience of citizens living in the West. In either scenario, however, it proves the essential tenets of Modern Monetary Theory (MMT) may hold true: that governments allocate resources according to the money they create.

Modern Monetary Theory as a Blank Cheque

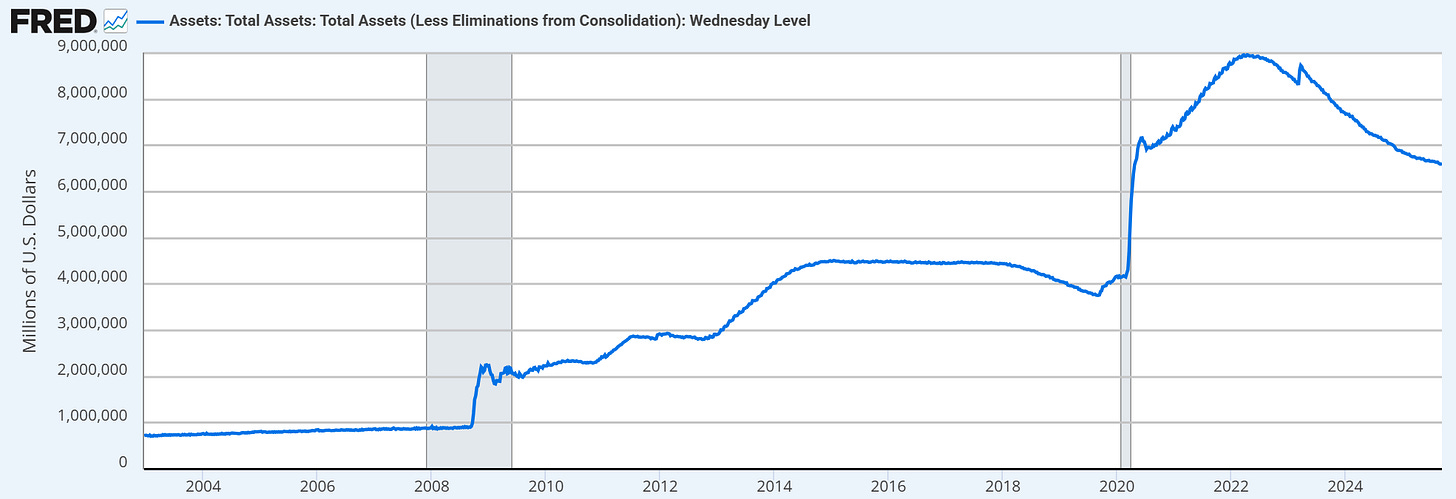

How is this the case on the Anglo-American side? The first and most prominent example could be the indirect debt monetization program that the Federal Reserve took on by buying mortgage-backed securities in the wake of the Great Financial Crisis, driving off dollars that would have otherwise bought distressed assets, while simultaneously maintaining lower bond yields, higher housing prices and attempting to inculcate “wealth effects” which would drive consumer spending ever higher.

source: https://fred.stlouisfed.org/series/WALCL

These wealth effects are effectively a sort of UBI for asset holders. If you have housing, stocks or any meaningful assets, you feel richer, and as you feel richer, you consume more, which ultimately has a demand side effect in the American economy, and subsequently signals pass through to worldwide producers who export to the United States.

The United States establishment proceeded down this path in a hidden manner - while it was publicly available what Ben Bernanke planned and subsequently Janet Yellen and Jay Powell continued to sustain - the broader public was not sophisticated enough to pick up on it, and the financial community was not interested in encouraging them to do so should it ever create pause about the actual value of the so-called “wealth” that had been produced through rising asset prices.

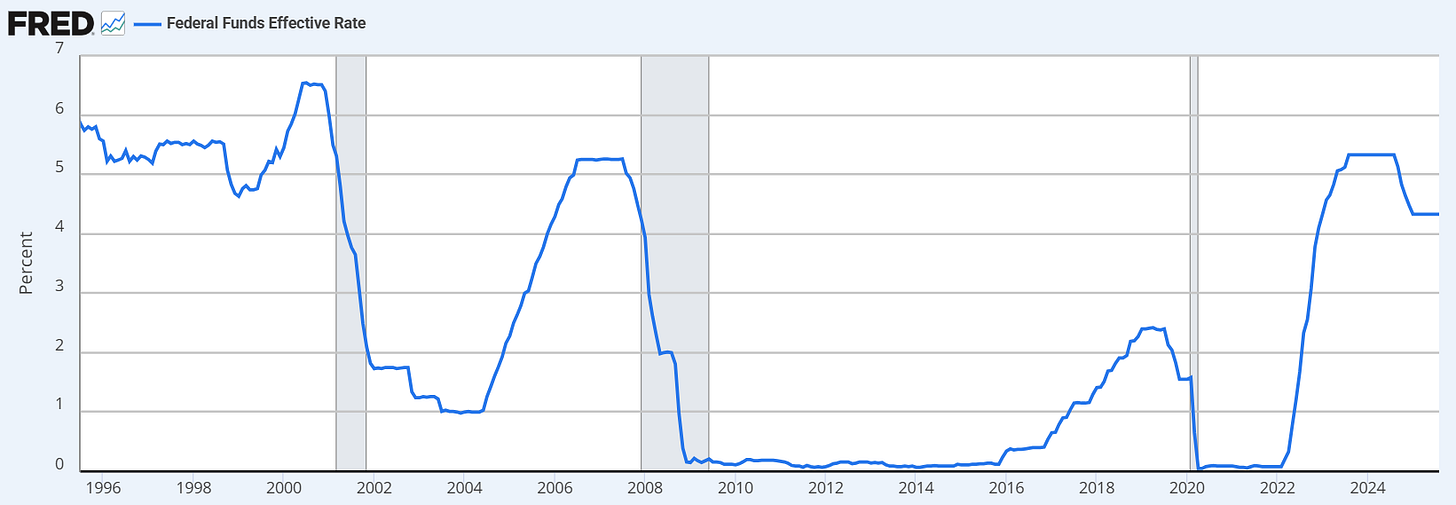

In the intervening period, partly since the beginning of Trump I, and moreso as instability wrecked the Repo market in 2019 and then into COVID-”obliged” stimulus in 2020 and 2021, the Fed compensated by raising rates past 5% after they had only been above 2% for about 1 of the previous 15 years, and had spent the majority of that period essentially at 0.

source: https://fred.stlouisfed.org/series/FEDFUNDS

This has laid the groundwork for implicitly recessionary real growth, with a weakening labor market and a concentration of investment to only perceived absolute winners (read: AI data centers). This “whiplash” follows COVID, but implies that the US economy is essentially capital constrained due not to the interest rate, but the directional heigh of the interest rate impeding confidence in investment and appreciating asset values. The Fed spent 15 years making its bed, and now it is lying in it.

Where does MMT enter the conversation? It exists essentially as the only solution to this, if not in name. US deficit to GDP is already at 6.2%, it typically rises by 3-5% during recessions and possibly more if they are severe, meaning that that figure could exceed 12 or 13% simply to sustain the economy through traditional cyclical challenges. This is a practice that destroys currencies, which would explain the current Gold bull market (though various recognitions of gold as currency have been imposed historically, both by FDR and Nixon). A government that cannot function in what is essentially normal cyclical environments without accumulating deficits in excess of 10% of GDP is a government that essentially already practices MMT - whether it is doing it to pay for social security or to build a base on Jupiter is beside the point of the matter.

Debt Monetization and the Creation of Common Goods

While the United States engaged down this egregious corruption of traditional financial capitalism, which once seemed to have winners and losers, China took liberties to create mounds of sometimes unpayable debt - now estimated at up to $11 trillion unaccounted for - which drove much of the real estate, infrastructure and technology development for which the country is now known today.

Under the assumption that China’s debt may be approaching 300% of GDP, what explains its ability to maintain and even continue to advance in its sabre-rattling against the West, making various attempts to form alternatives to the current international order? Essentially, there can only be one belief - that the idea of financial order no longer really exists. A few factors might explain this view.

Population contraction: Historically, populations only contracting during periods of war or plague, but fundamentally held a constant, if historically low growth rate. Currently, no major conflict persists (though regional ones flare up), and global birth rate is expected to fall below replacement rate as early as 2030. The financialization of the future economy under an assumption of growth, in labor, manpower or activity, is now broken, which implies that the constraints of traditional “insolvency” events may no longer apply.

Technology and Consumption Patterns: Increased consumption of digital goods, cheaper, easier to produce, and essentially replicas of real, physical experiences that used to cost far more in time, money and resources to achieve, means that consumption patterns are increasingly deflationary. This may be both symptom and cause in relation to financial markets, but more importantly, it means money must be handed out in order to get people to spend it, and with the current fiscal state of most governments, money must be created in order to then be handed out.

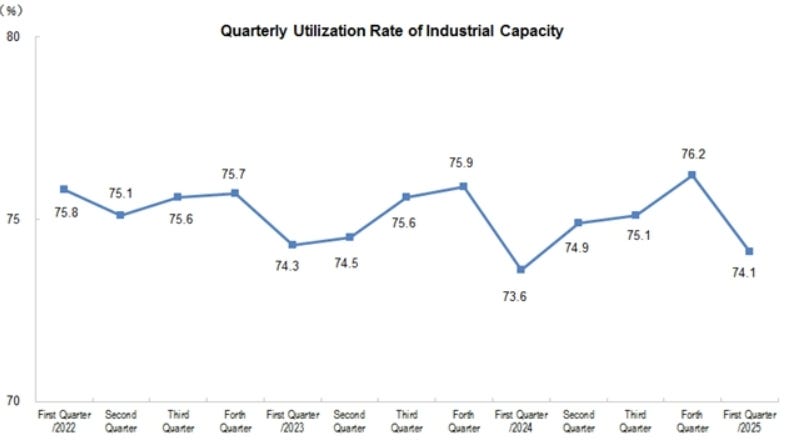

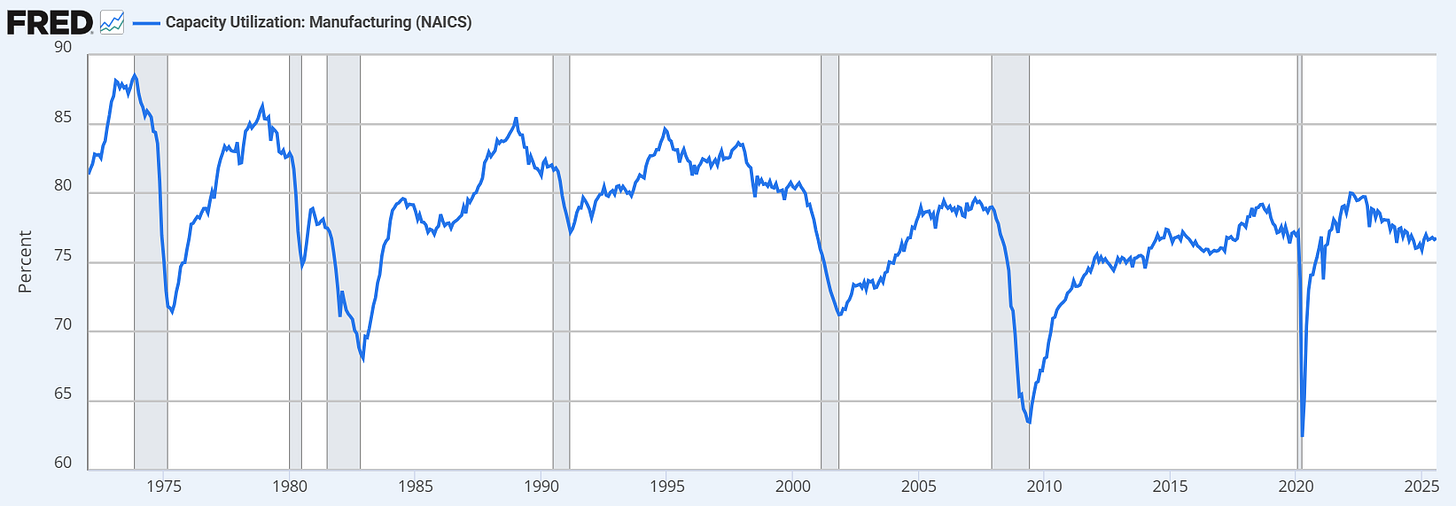

Attrition of Fixed Industrial Capacity: China has made tremendous investments in industrial capacity, at a time where the third world may be modernizing, but ultimately realizes lower total birth rates that cut off the possibility of indefinite growth. In this context, fixed capacity doesn’t really need to increase, and there is no increase in utilization at a systemic level which would imply a need to continue to increase investment. Without a higher intensity of renewal in fixed Plant, Property and Equipment, along with an increased consumption of digital goods in favor of physical goods - think Netflix and Uber instead of Cars and Homes - there is no lower-end wage pressure for labor-intensive sectors. The only way that this can at all be produced is through deficit spending that is essentially inflationary - especially if much of the labor market only “gets off its ass” at the promise of exceedingly high wages, which they will ultimately intend to spend on consumption, producing more inflation in the long run.

source: https://www.stats.gov.cn/english/PressRelease/202504/t20250425_1959461.html

source: https://fred.stlouisfed.org/series/MCUMFN

Productive and Non-Productive Public Investments

The United States is currently in a process of decoupling from China as a matter of strategic security, but China cannot export its way out of a Yuan that goes to zero. The United States is the cleanest shirt in the hamper - France is approaching a debt crisis, Russia doesn’t have the ability to act as a global financial broker even without sanctions, India is much the same, and China is pretending not to be broke.

The aversion to debt makes life difficult in the short term, but being more averse to debt than others makes one more successful in the long run. And yet, in a societal structure that will only accumulate more debt until people start choosing kids over screens (maybe this is not the case, but its hard to find evidence opposing it), then we can have no expectation of a financial realignment. Every party in the global economic system is accumulating debt equally, which means that every party can create debt in whatever manner it chooses.

China has chosen productive investments for which there may eventually be no market - you can only sell so many $10,000 electric cars (at practically no profit) before there is no one left to buy them, and if the population ultimately contracts at a global scale, that day may come much sooner than seems obvious.

MMT as The Path to Star Empire

In science fiction like Star Trek, it is assumed that society has moved beyond the basic need to accumulate currency and now focuses on scientific exploratory missions like discovering new planets (or whatever). If we live in a context where rising asset prices, rising debt, rising inflation and rising inequality can only seem obvious, what is the solution?

Direct redistribution ultimately takes away from productive investment because it punishes or otherwise discourages private individuals from making productive investment. Indirect redistribution, through money-printing that is funneled to the lower orders of society, also leads to inequality because that money goes to consumption which then permits higher profits for the owners of capital.

A mixed model economy may actually be a functional solution - where state-owned entities manage most of the day-to-day consumption generated by passive, debt-monetized consumers within society (places like Scandinavia and Quebec are good examples), but these societies appear to have it even worse when it comes to rates of depression, suicide and population replacement and overall labor productivity. So what else can compensate for this?

One can only presume, by inference, the conquest of the Stars.