Understanding the Real Limits of Affordability

Why More Stimulus Doesn't Always Produce Growth

While we are reaching the peak of PowerPoint presidencies (after all an immigration slide did save Trump’s life), the address by Donald Trump last night failed to show the economic coherence necessary to actually break the United States out of its long term fiscal and consumer deficits - let us explain.

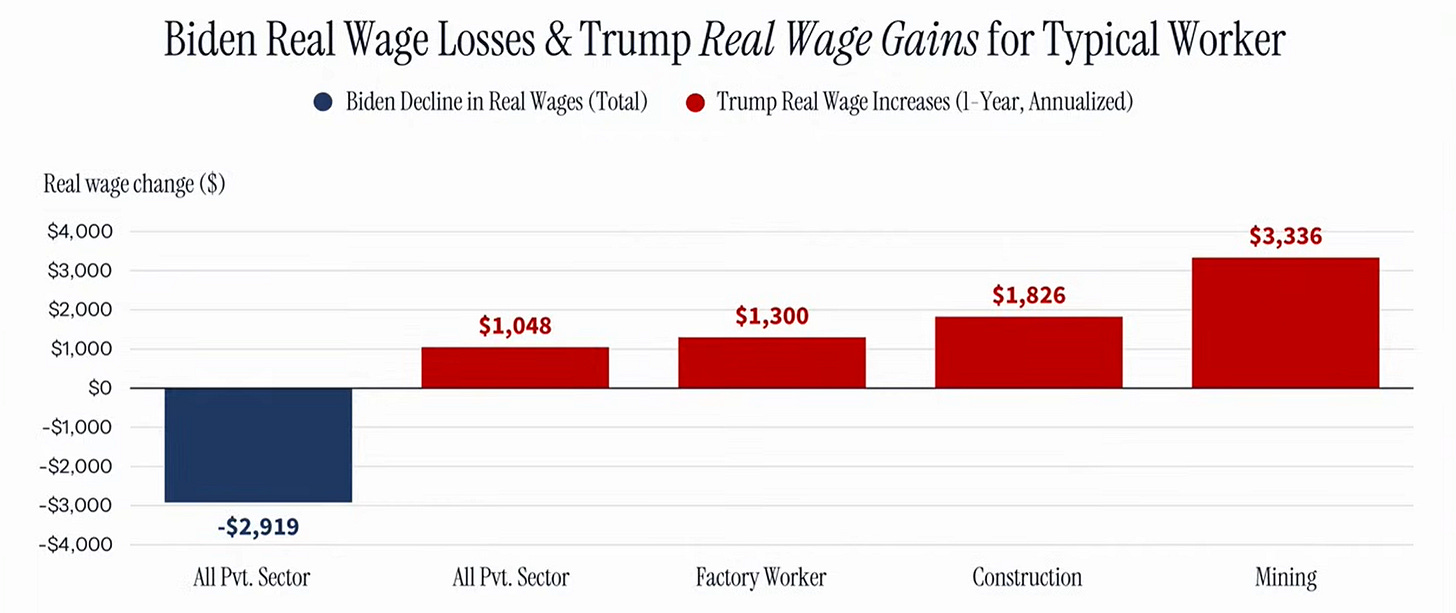

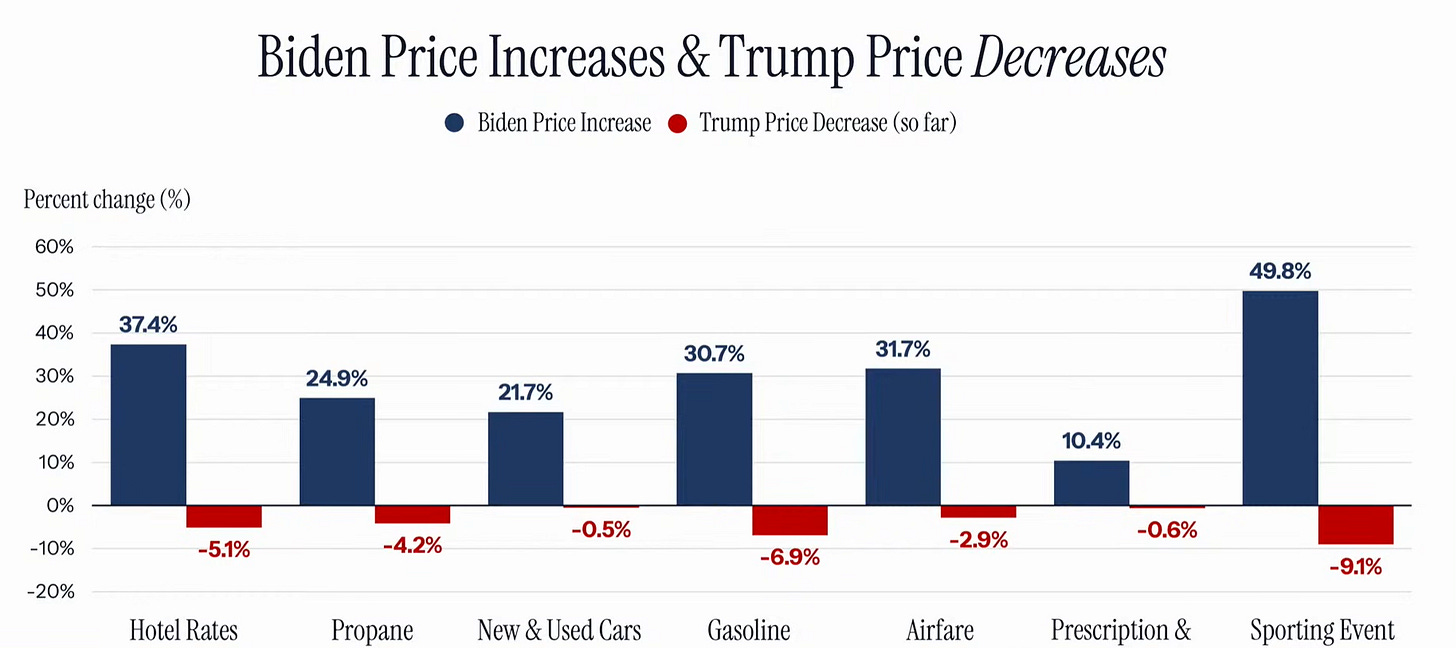

Trump made three key arguments and two key promises during his speech. The arguments: 1) prices are trending lower under Trump than Biden, 2) wage growth is beginning to exceed inflation for the first time since the last Trump administration and 3) many food categories have seen minor price decreases after substantial gains.

In contrast to the arguments, the two promises of substance offered were: 1) tax returns for the average family exceeding $11,000 USD and 2) a “warrior dividend” of $1,776 for each active serviceperson in the US military.

While the latter is obviously a backslide from the much-bandied “tariff dividend” (and a decent enough way to start building a mercenary mindset in the US military), the reality of these benefits is unfortunately reminiscent of the Biden administration, when the COVID-induced “American Rescue Plan” Act of 2021 promised additional tax credits and benefits of up to $10,000 for families of 4 below certain income thresholds, in addition to various other forms of stimulus which drew the avid criticism of Larry Summers.

It is no surprise that this legislation was followed by a surge in the costs of airfare, sporting events, cars, hotels, and all sorts of foodstuffs - these are the things that people with the highest propensity to consume end up consuming when they have a little extra cash. In fact, most stimulus taken on by the United States and western nations has seen the poor as simply a channel to subsidize demand - something generous enough, surely - but it is strictly opposite to the Chinese model of intensive subsidies in various components of the agricultural sector, including stockpiling, to maintain low food prices, low inflation, and consistently increasing productivity in the food sector.

Indeed, subsidies to alleviate bottlenecks in the food sector - whether it’s meat herd sizes, beef processing, the inputs for crops (which should be coming down with the price of oil), and incentives to increase the labor supply in these sectors - would all have direct impacts on the price of food. At the same time, food prices in particular, when high, do significant damage to productivity, whereas lower food prices enable other forms of consumption to benefit from scale and volume - whether that is in manufactured goods, hotel and leisure, or productive tools for work like electronics and home goods.

While imitating the Chinese model may seem un-American (hint: the “New Deal” showed that it really isn’t, even if it didn’t work all that well), subsidizing demand without adopting some aspects of “Capitalism with Chinese characteristics” will only make the situation worse. The American economy, due to its romance with neo-Liberalism, has become highly concentrated among large firms. In all aspects of the consumer economy, large firms will exhibit rent-seeking behavior around bottlenecks in the supply chain - something observed as early as another Roosevelt’s “Square Deal” - and government intervention is required to either break up the firms profiting from bottlenecks or otherwise taking direct economic action to alleviate the costs around the bottlenecks. When it comes to China, this same model is applied in almost every sector of the economy - energy and manufacturing the most notable.

While applying such methods to every sector will likely be an excess and undermine the overall efficiency of the US economy, adopting active state intervention around key bottlenecks will help drive: 1) increased social cohesion and family formation, 2) longer term sustained consumption and economic growth, 3) lower total debt to GDP, 4) increased total productive capacity within the US economy and 5) a better position to consolidation US empire while maintaining long term economic and demographic surpluses necessary to sustain US security concerns.

It may seem unbelievable right now, but these sorts of changes are absolutely necessary - without them, the United States will begin a terminal decline. The current administration is actually best positioned to implement this policy, as it is beholden to fewer special interests than the other side. The phrase “only Nixon could go to China” might apply, but one could also say that “only Trump could copy Xi”. For the libertarians in the crowd, it might be worthwhile to remind them that “the dose makes the poison”.